Alt Investments

Central Banks Load Up On Gold In Uncertain Times – WGC Study

As a bank talks about "de-dollarisation" and the role of gold, industry figures show that central bank appetite for the precious metal has risen, and gives pointers for what the sector expects.

Central banks have accumulated more than 1,000 tonnes of gold in each of the last three years, up significantly from the 400 to 500 tonnes average over the preceding decade, according to data from the World Gold Council.

The figures come at a time when the price of the yellow metal remains underpinned by worries about dollar weakness, trade policy uncertainty, and persistent inflation in the US and certain other developed countries.

Gold, which tends to be a classic “fear gauge” asset, can provide ballast in a portfolio.

On 24 June 2024, gold fetched $2,320 per ounce and has risen over the past 12 months to $3,378 per ounce, as of yesterday. (Source: BullionVault.)

“This marked acceleration in the pace of accumulation has occurred against a backdrop of geopolitical and economic uncertainty, which has clouded the outlook for reserve managers and investors alike,” the WGC report said.

The 2025 Central Bank Gold Reserves (CBGR) survey, conducted between 25 February and 20 May, attracted 73 responses, which the WGC said was the highest since it began to survey the market eight years ago.

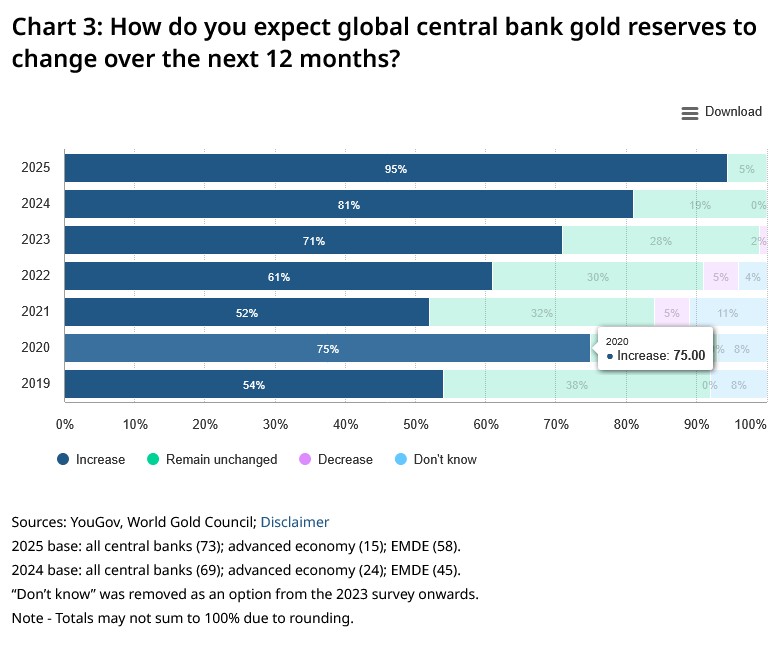

Echoing findings from previous surveys, central banks continue to hold favourable expectations on gold. Respondents overwhelmingly (95 per cent) said global central bank gold reserves will increase over the next 12 months.

The report chimes with a generally positive view of gold by banks. For example, in its semi-annual outlook for this year, yesterday, Netherlands-headquartered ABN AMRO told journalists in London that there appears to be a “new regime” affecting the gold market – a “de-dollarisation” trend and consequent flight of central banks to gold. “Past rallies in gold have been mainly driven by private investors, but not this time. Aware of the dollar weaponisation, China’s PBoC has recently been increasing its gold holdings, at the expense of USD reserves,” the bank said. In the rise of gold over recent times, private investors haven't – as yet – been a major force, it said.

Christophe Boucher, chief investment officer at ABN AMRO Investment Solutions, said the "de-dollarisation" trend – a term referring to lower non-US use of the American currency – is playing out. Over the past 10 years, foreign holdings of the greenback have fallen to 57 per cent from more than 70 per cent. A related issue is whether US Treasuries are a safe haven any longer. Usually, when equities fall – as they did after the 2 April "Liberation Day" tariff announcement – bond prices rise, but they did not do so on that occasion.

Boucher discussed journalists' concerns of whether the US would impose a withholding tax on profits held by holders of US Treasuries ("section 899"), and how the very fact that such ideas could be floated was weighing on Treasuries and the dollar.

However, if the dollar does lose its predominance – going back to the immediate post-war period – it will take time. "You cannot change the international monetary system in a few years," he said.

(This publication has reflected on a potential "vibe shift" in how gold is seen in the banking and wealth management industry.)

Rising reserves expected

This year, a record 43 per cent of respondents said that their

own gold reserves will also increase over the same period, the

WGC report said. None of its respondents anticipate a decline in

their gold reserves.

Source: World Gold

Council, Central Bank Gold

Reserves Survey 2025

Most respondents (73 per cent) see moderate or significantly lower US dollar holdings within global reserves over the next five years. Respondents also believe that the share of other currencies, such as the euro and renminbi, as well as gold, will increase over the same period.

The survey highlighted an uptick in respondents who actively manage their gold reserves, from 37 per cent in 2024 to 44 per cent in 2025.

The Bank of England remains the most popular vaulting location for gold reserves amongst respondents (64 per cent); a significantly higher percentage of respondents reported some domestic storage of gold reserves this year compared with last year (59 per cent in 2025 vs 41 per cent in 2024).